Table of Contents

Introduction

The adoption of blockchain technology has increased dramatically over the past few years. Blockchain is proving to be very useful in digital asset management. “Digital Asset Management” (DAM) is the systematised management of digital assets like images, videos, voice recordings, and documents.

Large, centralised databases have often handled digital asset management. Under such a setup, all digital assets are stored in one location, and a centralised body manages access. The centralised method, however, has several serious problems, such as the possibility of security breaches and data loss. Instead, blockchain technology provides a decentralised and trusted system for managing digital assets.

DAMs have developed tremendously, and in many cases, they now specify a special technique to close the gap between the expectations of the business or the industry and the digital assets. This is where Blockchain enters the picture. Blockchain technology offers a safe, decentralised way to manage these digital assets.

Blockchain And Its Potential For DAM

Over the past few years, digital assets’ value and significance have increased. The question is how to optimize the management of these resources.

The blockchain is a secure, decentralized, distributed ledger system to implement, administer, and invest in decentralized digital asset management strategies. When assets are moved across different network systems, the asset management strategy keeps track of all the associated transactions. They carry intellectual property ownership, attribution, and other aspects in every transaction. By verifying the authenticity of users and preventing unauthorized changes, blockchain technology ensures the safety of digital asset transfers and prevents unauthorized use of stored digital assets. Two blockchain experts, Don and Alex, said, “Blockchain is a decentralized, immutable digital ledger of economic transactions that can be designed to record nearly any exchange of value,”.

With all its potential applications, blockchain must be included in every DAM framework. Organizations dealing with high-security data or major enterprises operating on their validation networks can benefit greatly from incorporating blockchain into their Digital Asset Management Strategy. Therefore, businesses need Blockchain service providers’ assistance constructing a convincing business case for their DAM solution. Even though there aren’t many Blockchain service providers, finding and working with one will help you make a secure, strong Digital Asset Management Strategy.

What are Digital Assets?

Any asset that has a right to use and exists in digital form is called a digital asset. Cryptocurrency and blockchain technology-related digital assets are among the most popular examples. They include digital currencies, non-fungible tokens (NFTs), and virtual metaverse properties.

The concept of digital assets is incredibly broad and encompasses a wide variety of goods, including images, movies, and documents, to mention a few. A digital asset could be a photo you took and uploaded to your computer or phone. It’s saved in a digital format, and you have the right to use it as the photographer, so you can post it on your website or sell it.

Significance of Digital Asset Management Blockchain

Digital Asset Management

To streamline critical asset procedures and transform data into meaningful insights, Asset Managers use Digital Asset Management.

Digital Asset Management:

- Ensures the right way to store data assets

- Allows for the faster creation of data assets

- enables the simple distribution, search, and storage of assets across many channels

- Boosts governance and security of digital assets

- Boosts the speed of production and delivery

- Helps keep track of licenses for digital assets

- Eliminates or greatly lowers the possibility of legal trouble resulting from out-of-date licensing for critical assets

- Increases time efficiency by easing asset distribution between channels.

Blockchain

Blockchain is likely the next great technological achievement after cloud computing, with significant interest in its potential uses and widespread attention from consumers and businesses. Enterprise-level blockchain technologies like Ethereum, Corda, and Hyperledger have gained a lot of support

and use over the past year. Hyperledger was led by IBM and is supported by well-known technology companies like Intel and Oracle and financial services firms like JP Morgan, ABN AMRO, and Wells Fargo. This year, the Ethereum Enterprise Alliance was formed with members like Microsoft, Banco Santander, National Bank of Canada, ING, and Cornell University’s research group.

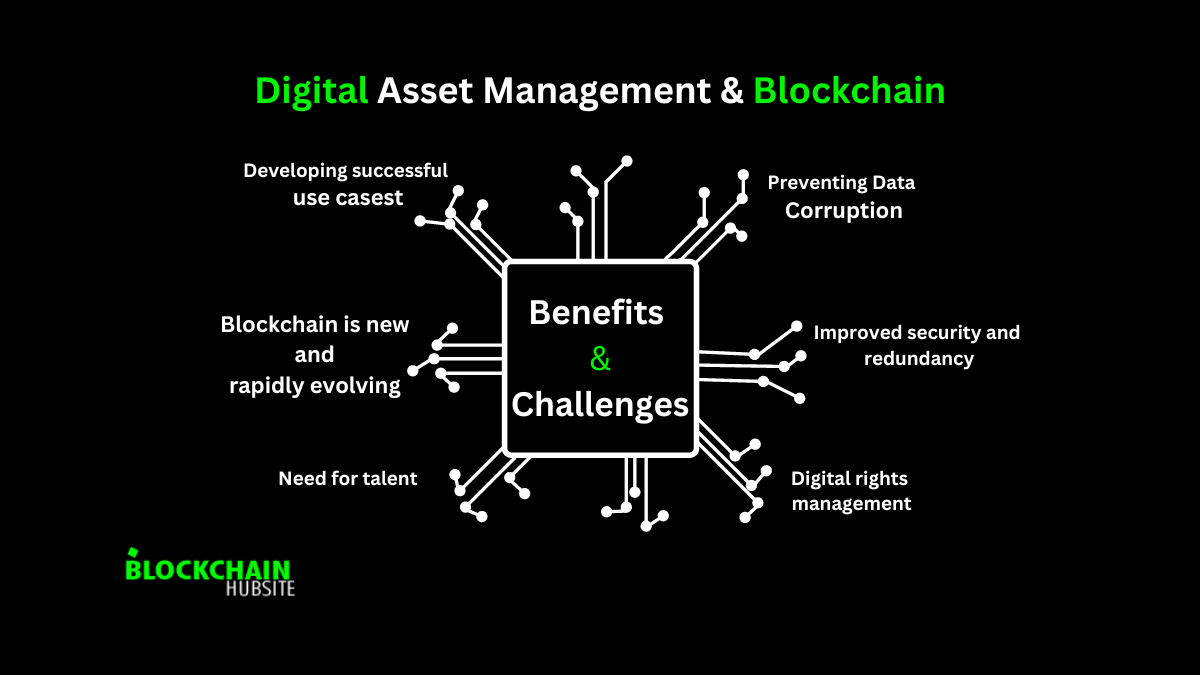

Advantages of Blockchain Digital Asset Management

Preventing Data Corruption

You might assume that the primary purpose of database transaction logs is to detect and prevent fraudulent transactions (although that can still be a factor). In reality, it’s primarily about preventing corruption due to system failures or programming mistakes. This is necessary for databases to copy records in real-time reliably. If one server that stores them goes down, another could pick up where the first one left off, with no data loss.

Improved security and redundancy

Distributed denial of service attacks are one method hackers use to damage networks. Costs associated with DDoS defences tend to be high because of the volume of traffic they try to handle. DDoS attacks focus on a single server, a single failure point. A decentralized blockchain doesn’t have a single point of failure. Several projects are considering blockchain as a potential dedicated DDoS defence system, which would optimize bandwidth and decrease costs.

If your company employs DAM software, you already know about redundancy and distribution mechanisms like failover systems and Content Delivery Networks (CDNs). Blockchains have the potential to offer the same global redundancy and access to Digital Asset Management as existing alternatives.

Similarly, blockchains designed for file storage create a network prioritizing public access to data above the private management of content delivery networks (CDNs). This ensures that the risk of unavailability is distributed among network nodes and across the separate enterprises that administer them.

Digital Rights Management

Databases are the foundation of specialized Digital Rights Management solutions. The primary challenge is verifying ownership and managing complicated usage rights.

Traditional contract administration is necessary for analogue systems, while blockchains eliminate this requirement. Non-fungible tokens and programmable smart contracts are used in these. As ownership is very clear, self-executing contracts can be used to transfer digital rights.

Disadvantages of Blockchain Digital Asset Management

Despite the advantages, it is still crucial to consider other factors and potential implementation challenges.

Blockchain technology is new and rapidly evolving

Blockchain 2.0 represents a maturation of the technology, but it is still evolving, necessitating the ongoing development of decentralized software (dApp) for Digital Asset Management.

Developing successful use cases

There is yet to be a set of successful use cases for blockchain outside the cryptocurrency industry. These success stories must be immensely revolutionary to justify this technology’s investment and implementation risks.

Need for talent

Blockchain developers are in high demand, but supply and demand issues may slow the rate at which the technology advances and is adopted.

Future Outlook

Blockchain networks are classified into three types: public, private, and consortium. Everyone is welcome to join and participate in public networks. Companies often utilize private networks internally, inside business units with recognized participants. A pre-selected group of network nodes manages the consensus process in a partially decentralized consortium where participants are known to the consortium members.

The tremendously revolutionary Blockchain vision for the DAM sector is for content distribution to be decentralized and democratized in a public blockchain network where media asset producers may publish, broadcast, and share their work and be paid for the value they create. Yet, right now, this is more of a moonshot than a workable approach. We need a federation of digital asset media libraries that can act as a distributed and decentralized system of record’ for digital media in an enterprise Blockchain environment. As a first step, we will create clear media asset ownership rights and attribution for media assets before tackling the much bigger and more difficult content licensing and distribution area.

conclusion

In conclusion, Blockchain technology and Digital Asset Management (DAM) are two quickly developing industries entwining more. Blockchain technology can transform how digital assets are handled, stored, and distributed by improving security, transparency, and efficiency. The immutability and decentralization of blockchain can enhance DAM systems, resulting in a tamper-proof and trustworthy digital asset management system.

Blockchain technology may simplify digital asset management procedures, cut expenses, and enable safe and dependable transactions by utilizing smart contracts and decentralized storage. Moreover, by utilizing cryptocurrencies and tokenization, integrating blockchain technology with DAM systems might allow new business models for creators and content owners.

As the digital economy expands, the use of DAM and blockchain technologies will become increasingly important. Businesses who adopt these technologies early on will be better positioned to compete and capitalize on the full potential of the digital revolution. However there are still issues to be resolved, including scalability, interoperability, and standardization, as with any newly developed technology. Therefore, the future of blockchain and DAM technology is bright, and we can anticipate more advancement and innovation in both areas in the years to come.

FAQs

1. What is the difference between crypto asset and blockchain?

A blockchain is a distributed ledger system that provides a safe and transparent method of recording and validating transactions. It is the basis for cryptocurrencies and other digital assets.

In contrast, a crypto asset is a digital asset that controls the production of new units and employs cryptography to safeguard and verify transactions. While most crypto assets employ blockchain technology, some may use alternative kinds of distributed ledger technology or be centralized.

2. What are the two types of digital assets?

The two types of digital assets are fungible and non-fungible assets. Fungible assets are interchangeable, while non-fungible assets are unique and not interchangeable.

3. How blockchain will change asset management?

Blockchain will revolutionize asset management by increasing security, transparency, and efficiency through a tamper-proof and trustworthy digital asset management system supported by smart contracts and decentralized storage.

4. Is blockchain a token or coin?

Blockchain is not a token or coin but a distributed ledger technology that enables safe and transparent transactions for digital assets, including cryptocurrencies and tokens.

5. What are digital asset platforms?

Online platforms that facilitate the development, issuance, trading, and administration of various digital assets, such as cryptocurrencies, tokens, and non-fungible assets, are known as digital asset platforms. These platforms enable many kinds of transactions and give consumers a safe, open method to engage with digital assets.

6. What is blockchain asset management?

Blockchain asset management uses blockchain technology to manage and track assets such as cryptocurrencies, tokens, and other digital assets. It enables safe and transparent asset management, with the potential for cost savings and enhanced efficiency.

7. What are the four types of crypto assets?

Crypto assets are classified into four types: cryptocurrencies, utility tokens, security tokens, and stablecoins. Cryptocurrencies are digital currencies that employ cryptography for security; utility tokens allow access to a product or service; security tokens represent an ownership share in an asset; and stablecoins are meant to maintain a stable value.

8. What is digital asset security?

“Digital asset security” refers to procedures, technologies, and protocols to guard against theft, manipulation, and illegal access to digital assets like cryptocurrency. It entails putting security precautions in place, including encryption, multiple-factor authentication, and safe storage to guarantee the confidentiality and integrity of digital information.

9. What is digital property?

Digital property includes any valuable digital assets or material, including digital money, digital artwork, and domain names. These assets can be owned, transferred, and stored electronically and are protected by digital property rights. NFTs, Bitcoin, Ethereum, and online intellectual property including copyrights, patents, and trademarks are a few examples.